From policy restrictions to property taxes, this guide walks you through the latest 2025 regulations for purchasing property in Singapore, helping you navigate the challenges and find the perfect home or investment opportunity!

As a global financial hub, Singapore attracts numerous multinational companies to establish their Asia-Pacific headquarters here. Consequently, many expatriates work, live, settle, or retire in Singapore. Families often choose to send their children to study in Singapore, with some even relocating the entire family.

Whether for work, living, or education, most people start considering property ownership after residing in Singapore for a while. Singapore is known for its beautiful environment, robust economy, consistently stable property prices, and some of the lowest mortgage rates globally. Buying property here can fulfill personal living needs while offering rental or long-term investment opportunities with significant potential for appreciation.

Can Foreigners Buy Property in Singapore?

The short answer is yes, but it’s essential to understand the relevant policies.

In Singapore, property buyers are required to pay Buyer’s Stamp Duty (BSD), which ranges between 3% and 6%, depending on the purchase price.

Additionally, foreigners must pay an Additional Buyer’s Stamp Duty (ABSD) of 60%, unless they are citizens of the United States, Iceland, Liechtenstein, Norway, Switzerland, or Permanent Residents (PR) from these five countries due to Singapore’s Free Trade Agreements.

What Types of Properties Can Foreigners Buy in Singapore?

Given Singapore’s limited land resources, the government prioritizes housing for its citizens by providing various support schemes for public housing, such as affordable Housing Development Board (HDB) flats.

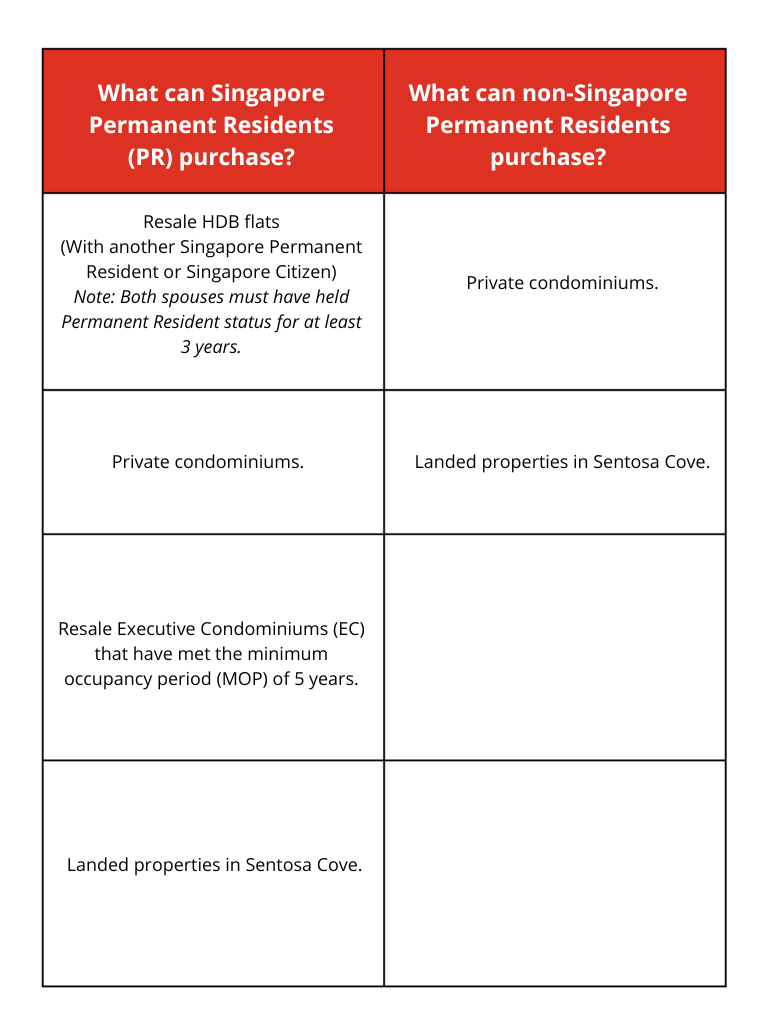

For foreigners, options are more limited:

Can Foreigners Get a Loan for Property Purchases in Singapore?

Yes, foreigners can apply for loans from banks or financial institutions in Singapore. However, the loan amount and down payment will depend on factors such as the buyer’s loan history and loan tenure.

Many expatriates and foreign students choose to invest in properties in Singapore. This allows them to live in their purchased home during their stay and potentially generate income by renting or selling the property later. This makes property ownership a lucrative investment option.

If you’re considering buying property in Singapore, feel free to reach out to us. We provide comprehensive, up-to-date property information to help you make informed decisions and ensure a smooth purchasing process!